Go to globalwitness.org to view the complete report on British banking complicity in Nigerian corruption.

Barclays, HSBC, UBS, others ‘fuel corruption in Nigeria’ (Nigerian Compass):

Barclays, HSBC, NatWest, Royal Bank of Scotland and UBS – have been linked to money laundering scam over which some corrupt Nigerian politicians were indicted.

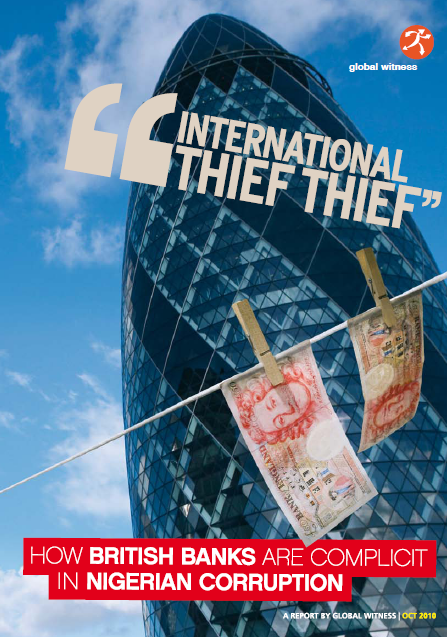

A report entitled ‘International Thief Thief’ from Global Witness, a Non-Governmental Organisation (NGO) that exposes the corrupt exploitation of natural resources and international trade systems, drives campaigns to end impunity, resource-linked conflict, and human rights and environmental abuses, accused the banks of fueling corruption in the world’s most-populous black nation.

In a 40-page report published yesterday in www.globalwitness.org, Global Witness said that the five banks had taken millions of pounds between 1999 and 2005 from two former governors accused of corruption (Diepreye Alamieyeseigha of Bayelsa State and Joshua Dariye of Plateau State), but had failed sufficiently to investigate the customers or the source of their funds.

Barclays, HSBC and UBS are all members of the Wolfsberg Group, an international body set up in 2000 to try to improve global anti-money laundering procedures.

The report said the banks might not have broken the law, but had helped to fuel corruption in Nigeria.

Global Witness said its findings were based on court documents from cases brought up in London by the Nigerian government to get funds returned that it said had been stolen by the two former governors.

Alamieyeseigha was accused of corruption in 2005 when he was caught with almost a million pounds in cash in his London home, and was briefly jailed in Nigeria after pleading guilty to embezzlement and money laundering charges two years later.

Dariye was arrested in 2004 in London and was found to have purchased properties worth millions of pounds even though his legitimate earnings amounted to the equivalent of 40,000 pounds ($63,500) a year.

He returned to Nigeria, where the anti-corruption agency has accused him of looting public funds. He has denied wrongdoing.

Said the report: “What is so extraordinary about this story is that nearly all of these banks had previously fallen foul of the UK banking regulator, the Financial Services Authority (FSA), in 2001 by reportedly helping the former Nigerian dictator, the late General Sani Abacha, funnel nearly a billion pounds through the UK. These banks were supposed to have tightened up their systems but as this report now shows, a few years later, they were accepting corrupt Nigerian money again. There is no sign that the FSA has taken any action this time.”

UK Banks Draw Fire For Nigerian Accounts (Wall Street Journal):

Banks that allowed two Nigerian politicians to open accounts should have known better, according to Charles Intriago, founder of the International Association for Asset Recovery, a group devoted to recovering illicit assets.

A report released Sunday by U.K.-based anticorruption group Global Witness, “International Thief Thief,” accuses Barclays PLC, HSBC Bank PLC, Royal Bank of Scotland, NatWest (owned since 2000 by RBS) and UBS AG of holding accounts containing allegedly illicit funds for two Nigerian state governors, Diepreye Alamieyeseigha of Bayelsa State and Joshua Dariye of Plateau State, from 1999 to 2005. None of the banks would comment to Corruption Currents on the alleged accounts, though some commented more broadly on their procedures – see below.

Alamieyeseigha pleaded guilty in July 2007 to six counts of money laundering and corruption, receiving six concurrent two-year jail sentences and an order to forfeit his illicit assets, and was released a day after the sentencing for time served while his trial dragged on. Dariye still awaits trial on 23 counts of theft, corruption and breach of state trust in Nigeria. A woman convicted of laundering GBP1.4 million for him in Britain received a three-year jail sentence in April 2007.

Nigeria’s constitution bans politicians from holding bank accounts outside the country, and after the guilty plea, the Nigerian government successfully sued Alamieyeseigha, his shadow companies and “others” (pdf) in U.K. court in 2007 to reclaim his illicit assets, which included several properties and bank accounts held under his name and those of the shadow companies at UBS, HSBC and RBS.

Intriago said that Nigeria is world-renowned for corruption, much like his native Ecuador. Nigeria ranks 130th in the 2009 edition of the Transparency International Index of most corrupt countries.

“For anyone to open a big account for Nigerians is asking for trouble, if not ‘willful blindness,’ which the courts define as ‘the deliberate avoidance of knowledge of the facts,’” he said in an interview.

An HSBC spokesman called the report’s allegations “misguided,” adding that “rigorous and robust compliance procedures were followed diligently.” He wouldn’t comment further. The bank’s U.S. units received a cease-and-desist order last week from the Fed and the Office of the Comptroller of the Currency, requiring it “to take corrective action to improve its firm-wide compliance risk-management program,” including its anti-money laundering compliance procedures.